Afterburners vs. Supercruise: The Startup Propulsion Dilemma

How Venture-Backed and Bootstrapped Companies Mirror Aviation Technologies in Their Growth Strategies

Venture-backed startups and afterburning jets share a common strategy: rapid, intense acceleration fueled by massive resource consumption. Just as afterburners inject fuel directly into the exhaust stream to dramatically boost thrust, venture capital infuses startups with large sums of money to accelerate growth at an extraordinary pace. This approach allows for quick market penetration and scaling, but at the cost of high "fuel burn" - in startups, this translates to high cash burn rates.

The afterburner analogy extends to the temporary nature of this boost. Jets can only sustain afterburner use for limited periods due to excessive fuel consumption and engine strain. Similarly, startups must transition to more sustainable business models before their funding runs out, or risk a rapid, fiery burnout.

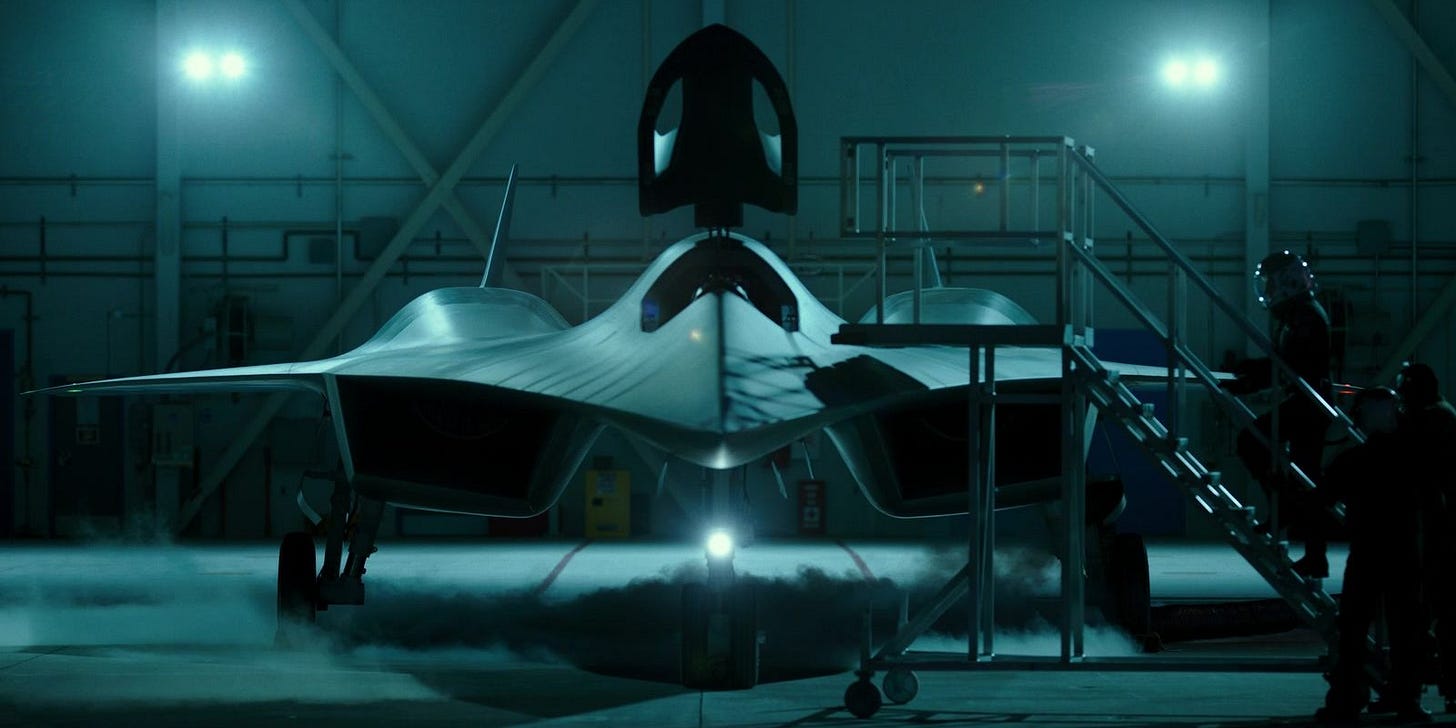

In contrast, bootstrapped, capital-light companies resemble aircraft utilizing supercruise technology. Supercruise allows jets to achieve supersonic speeds without afterburners, using advanced engine design and aerodynamics for efficiency. They are structurally engineered for sustained supersonic flight. Bootstrapped companies likewise aim for sustainable, organic growth by optimizing their business models and operations rather than relying on external fuel injection.

This approach offers several advantages:

Efficiency: Supercruise and bootstrapping prioritize doing more with less, maximizing output per input unit.

Sustainability: Both can maintain high performance for extended periods without exhausting resources.

Stealth: Supercruise aircraft are less detectable; bootstrapped companies often fly under competitors' radars until they've established a strong market position.

Flexibility: Without dependence on external resources, both can adapt more quickly to changing conditions.

However, the supercruise approach also has limitations. It may not achieve the same peak speeds as afterburner-equipped jets, just as bootstrapped companies might grow more slowly than their venture-backed counterparts. The key is finding the right balance between speed and sustainability for the mission at hand.

A critical aspect of this analogy is the necessity of choosing an approach early in the journey. Just as an aircraft's propulsion system can't be overhauled mid-flight, companies often find switching between venture-backed and capital-efficient models challenging once they're scaling. The initial choice of "engine" - be it the high-powered, resource-intensive afterburner or the efficient, sustainable supercruise - largely determines the trajectory and options available to the company throughout its growth. This decision must be made carefully considering the company's long-term goals, market conditions, and the founders' risk tolerance. While pivots are possible, they often come at a significant cost in terms of time, resources, and momentum.

While the afterburner approach of venture-backed startups can yield spectacular short-term results, the supercruise model of bootstrapped companies often leads to more sustainable long-term success. As in aviation, the best approach depends on the specific goals, market conditions, and available resources. The key is to make this crucial decision early and strategically, as changing course mid-flight can be a complex, risky, and even fatal.

Come cruise with us!